Elderly Smartwatch Trends 2026: How OEM/ODM Brands Can Compete with Global Leaders

2026-01-22

Elderly Smartwatch Trends 2026 marks a turning point in connected eldercare. As the senior wearable market 2026 becomes more sophisticated, devices such as elderly smartwatches, SOS pendants, GPS tracker for elderly solutions, and telecare hubs are evolving from accessories into essential care infrastructure. Global consumer brands are building wellness ecosystems, but telecare operators and healthcare platforms increasingly ask for customized, regulatory-ready hardware that plugs cleanly into their workflows. For a telecare device OEM - such as JiAi Intelligent Technology - this shift opens a practical path to leadership through purpose-built hardware, tuned firmware, and robust platform integration.

Trend 1: Purpose-Built Senior Wearables Over General Smartwatches

Mass-market watches are designed for fitness and notifications; emergency care is often an afterthought. In eldercare, clarity and speed are non-negotiable. Purpose-built designs close the gap.

• One-Button Emergency Flows

A single, tactile SOS control reduces hesitation. Reliable alerts are built on redundant links - cellular (eSIM/SIM) with Wi-Fi failover - and user feedback via voice and vibration to confirm help is coming. Alerts should be routed by preset rules to caregivers, family, or call centers, eliminating menu navigation.

• Senior-Centric Interfaces

Reduce cognitive load with large typography, high-contrast themes, and consistent haptics. Make SOS, caregiver calling, and battery status front-and-center on lockable tiles to prevent mis-taps. In bespoke smartwatch design, prioritize UI patterns that reflect assisted living routines - not fitness app behaviors.

• Continuous Fall Monitoring With Minimal False Alarms

Always-on protection combines quality IMUs, senior-specific motion models, and a progressive confirmation chain: a haptic cue, a voice inquiry, then auto-escalation if there's no response. Add inactivity signals, hard/soft fall distinction, and optional indoor positioning to accelerate intervention while preventing alert fatigue.

• Direct Integration to Care Platforms

Outcomes depend on real-time interoperability. Provide open APIs, MQTT/HTTP streaming, and documented webhooks so alerts, vitals, and status flow into operational dashboards, EHRs, and dispatch centers. JiAi's integrations add governed routing, SLA transparency, and traceable audit logs to maintain service quality across fleets.

In 2026 eldercare, compliant OEM/ODM builds - custom hardware, validated firmware, and standards-based integrations - will outperform mass-market consumer devices in institutional environments.

Trend 2: Telecare Ecosystems Instead of Standalone Devices

Operators are choosing ecosystems over single devices. Interoperable modules strengthen reliability and simplify day-to-day management.

• Smartwatch and Pendant Choices

Active residents often prefer watches, while pendants excel for those with dexterity or vision limitations. With unified alert logic and common data models, caregivers can select the right device per resident - no retraining, no workflow reconfiguration.

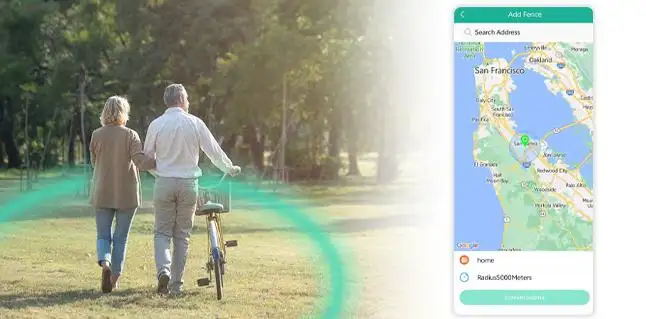

• Indoor Positioning That Complements GPS

Indoors, BLE beacons or Wi-Fi RTT deliver room-level accuracy; outdoors, GPS takes over. Indoor Positioning That Complements GPS. Context-aware transitions deliver continuous tracking, switching to indoor BLE/Wi-Fi RTT at entry to avoid service gaps while GPS covers outdoor movement.

• Telecare Hub or Home Gateway

Gateways reduce device strain to extend battery life and stabilize links, with offline caching, edge analytics, and local voice prompts. For multi-resident deployments, they unify data and alerts across devices, lowering support overhead.

• Cloud Monitoring for Teams

Centralized monitoring pools alerts, performance trends, and device health for clearer oversight and compliance reporting. Role-based views help clinical and admin teams hone in on mobility, nighttime activity, exceptions, and plan-based compliance.

• Assisted Living Console for Operations

The operations console simplifies admissions, device assignment, shift handovers, and incident documentation. Integrated with wearables, the console acts as the single source of truth for operations.

By 2026, procurement will prioritize device-plus-platform-plus-data integration. JiAi Intelligent Technology already supports senior smartwatches, GPS tracking wearables, SOS pendants, telecare hubs, monitoring consoles, and API/MQTT/HTTP integrations - each module interoperable with the others.

Trend 3: Longer Battery Life and Ultra-Low Power Design

Battery endurance is a key driver of total cost and care reliability. Devices that last longer reduce maintenance, prevent dropped monitoring, and increase adoption.

• Week-Plus Real-World Standby

Seven to fourteen days of standby under typical usage - scheduled status pings, periodic heart rate checks, and motion sensing - reduces charging anxiety for seniors and workload for caregivers.

• LTE-M/NB-IoT Connectivity Done Right

Low-power wide-area networks improve coverage in difficult buildings and cut energy use. Intelligent network selection, power-saving modes (PSM, eDRX), and adaptive retry strategies keep devices connected without overconsumption.

• AI-Assisted Power Management

Context-aware duty cycling adjusts sampling to the user's routine. When the wearer is still, the watch sleeps; when movement patterns change, it wakes and records at higher cadence. The result is both safety and endurance without manual tuning.

Public and private tenders in 2026 will select OEM/ODM offerings that combine efficient hardware, maintainable firmware, and fleet operations that lower lifecycle costs.

Trend 4: Customization for Operational Fit

Customization aligns with brand architecture, care workflows, and compliance frameworks.

• Housing and Brand Identity

Hypoallergenic finishes, splash protection, magnetic docks, and co-branding improve stakeholder acceptance. Small physical choices - strap texture, button travel, cradle alignment - matter in daily use.

• Configurable SOS Policies

Alert pathways should be policy-driven: multi-contact escalation, call center integration, geofenced behaviors (auto-alert outside safe zones), and silent alarms for sensitive scenarios. JiAi's firmware exposes templates that map to care protocols.

• Healthcare-Ready Data Bridges

From MQTT/HTTP to HL7 v2/FHIR, payloads map to clinical and operator systems. Consistent timestamps, event codes, and device identifiers simplify integration and compliance.

• Patient-Friendly, Multilingual Prompts

Local TTS, offline instructions, and dialect-aware support reduce misunderstandings. Across borders, language adaptability is a practical necessity.

• RF and Certification for Every Market

International healthcare deployments need tuned RF and certified frequencies. JiAi validates modem settings for regional networks to support reliable service.

Custom smartwatch development helps service providers own their product identity and avoid the compromises that come with rebranded consumer devices.

Trend 5: Regulatory-Ready Devices

Compliance is a core purchasing filter - especially in Europe and North America - where privacy, safety, and security are hard requirements.

• CE/FCC/RoHS and Beyond

Electromagnetic safety, radio conformity, and environmental standards must be documented and tested. JiAi aligns labs, manages end-to-end test planning, and produces the technical dossier to compress approval timelines.

• GDPR-Ready Data

Limit data to what's essential for clearly defined purposes; obtain, track, and manage consent; encrypt end-to-end (at rest/in transit); apply role-based access with least privilege; formalize retention timelines and deletion procedures; keep thorough processing records and access logs.

• Secure Firmware and OTA

Trusted boot with signature verification; efficient differential OTA packages; resilient A/B partitions; post-update health probes with safe rollback; staged waves (canary/cohorts) with operator pause/resume controls.

How OEM/ODM Brands Can Compete with Global Giants

| Comparison Dimension | Global Consumer Wearable Brands | OEM/ODM Senior Wearables |

| Core Market Focus | Personal lifestyle, fitness, and wellness tracking | Telecare services, assisted living, and remote patient monitoring |

| Primary Users | General consumer population | Seniors, long-term patients, carers, clinicians, and care institutions |

| Use Case Orientation | Activity metrics, sports performance, and health nudges | Urgent alerts, fall detection, vital sign monitoring, and care workflows |

| Product Design Priorities | Aesthetics, slim form factors, frequent product refreshes | Easy operation, robust build, extended battery life, dependable performance |

| Customization Level | Minimal customization with standardized offerings | Full-stack customization across device, firmware, and software |

| System Architecture | Closed systems with constrained third-party access | Open interfaces and modular platform integration |

| Data Integration | Designed for individual app-based experiences | Integrated with telecare platforms, medical records, and care management systems |

| Business Model | B2C-oriented premium retail pricing | Sustainable-cost B2B and B2G programs |

| Procurement Method | Individual consumer purchases | Institutional sourcing and large-scale deployment |

| Regulatory Adaptability | General consumer compliance standards | Flexible to regional healthcare, eldercare, and safety mandates |

| Scalability in Care Programs | Limited suitability for structured, long-term care | Designed to scale for long-term monitoring and care services |

Key Takeaway:

OEM/ODM senior wearables complement, rather than mirror, consumer wearables - bringing adaptable integration and cost-effective scalability purpose-built for institutional telecare and healthcare operations

Why JiAi Intelligent Technology Is Future-Ready for 2026

• A Decade of Senior Wearable R&D

Ten years of focused work on fall detection, SOS reliability, and elder-friendly UI translates into faster, safer product cycles for the senior wearable market 2026.

• In-House Hardware and Firmware Teams

Vertical integration lets JiAi tune sensors, radios, power systems, and software together, improving battery life and alert fidelity beyond siloed approaches.

• Flexible OEM/ODM Engagement Models

From turnkey white-label to bespoke development, JiAi scales with your sourcing strategy and brand architecture - de-risking pilot-to-production transitions.

• Complete Telecare Catalog

Watches, pendants, elderly GPS trackers, gateways, and caregiver consoles standardized on a single data and security framework for easier governance.

• Integration and Cloud Readiness

SDKs, sample schemas, and connector kits that compress project timelines and reduce internal engineering dependency.

• Global Compliance and Carrier Readiness

Out-of-the-box CE/FCC and carrier certifications, with regional LTE/LTE-M bands to unlock cross-market deployments.

Conclusion

The 2026 trend line points to specialized know-how, tailored device configurations, and interoperable platforms. Manufacturers fluent in telecare workflows and compliance will lead the category. JiAi combines deep R&D, low-power engineering, open integration, and global certifications - giving operators, insurers, and platforms a straight path to scalable, safer connected care.