Elderly Care Wearables in the Global Market: Key Trends and B2B Opportunities

2025-08-28

As a manufacturer, we see the Elderly Care Wearables Market shifting from niche to necessity. Healthcare systems, payors, and senior-care providers now prioritize prevention, always-on monitoring, and fast response. An Elderly Smartwatch or other Wearable Healthcare Devices does more than count steps - it builds a safety net that protects seniors, streamlines caregiver tasks, and helps institutions manage cost and risk.

❓ Why Elderly Care Wearables Are in Demand

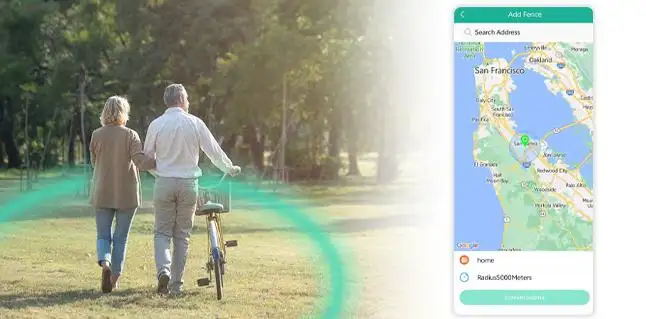

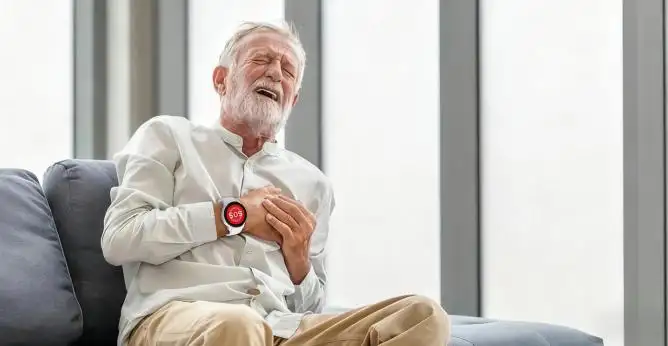

Population aging is the defining healthcare story of our time. Seniors want independence. Families want reassurance. Care teams want timely, reliable data they can act on. Well-designed Aging Population Technology connects these needs by tracking vital signals, flagging abnormal patterns, and enabling one-touch SOS support. From our OEM vantage point, adoption rises when devices are comfortable, discreet, and interoperable with clinical tools. That combination - fit, feel, and flow of data - turns a wearable into a daily habit rather than a gadget.

Global Market Size and Growth Drivers

The market has moved into a durable growth phase, expanding at double-digit rates as senior safety becomes a budget priority. Several forces are pushing the curve upward:

• Preventive economics: Remote monitoring reduces avoidable ER visits and escalations.

• Sensor + AI progress: Better algorithms cut false alarms and boost trust.

• Mainstream familiarity: As wearables go everyday, senior-focused adoption accelerates.

• Policy momentum: Telehealth and remote patient monitoring are increasingly supported by public and private programs.

Within the Elderly Care Wearables Market, the Elderly Smartwatch remains the most versatile form factor. It delivers continuous tracking, GPS-based safety, and rapid alerting in a single device that looks and wears like a watch.

Regional Opportunities

North America. Reimbursement pathways for remote patient monitoring and care-at-home models support enterprise rollouts. Health systems seek fleet-ready devices that connect to care platforms and electronic records. Pilot-to-scale roadmaps, bulk procurement, and outcome-based contracts are common.

Europe. Aging-in-place strategies and strict privacy standards shape buyer criteria. Distributors and providers value Custom Elderly Devices that meet GDPR expectations, offer data residency options, and support audited access. Localization - language, alert rules, and service workflows - often decides tenders.

Asia-Pacific. Japan and China have some of the largest senior populations and strong public-health initiatives. Cost-effective, connected solutions - especially OEM/ODM Smartwatch programs - fit government and municipal deployments. Community safety, chronic-care follow-up, and cross-generational caregiving are key use cases.

Key Trends in Elderly Care Wearables

Design with dignity. Seniors wear what feels good. Slim profiles, soft straps, and subtle styling increase daily adherence. When a device stays on the wrist, data completeness improves - and so does the clinical value.

Smarter detection. Multi-sensor fusion pairs accelerometer data with heart-rate variability and motion patterns, improving fall detection and wellness insights. Cleaner signal means fewer false alerts and faster, targeted responses.

Seamless data journeys. Open APIs and secure dashboards let care teams triage, escalate, and document within existing workflows. Interoperability is now a prerequisite, not a feature.

Customization at scale. B2B buyers want devices that match their brand and operations. Hardware options (materials, bands, casing) and software layers (dashboards, alert routing, integrations) turn a generic wearable into a differentiated service.

At JiAi Intelligent Technology, we build Wearable Healthcare Devices for home, community, and hospital environments: easy-to-read AMOLED displays with large, high-contrast fonts; real-time health tracking for heart rate, activity, and sleep; dedicated SOS with fall-event alerts; 4G LTE plus GPS for location accuracy; IP67 durability for daily life; and smooth performance backed by a dual-CPU architecture. Our platforms integrate with institutional dashboards to deliver the right alert to the right person at the right time.

Opportunities for B2B Buyers

Healthcare institutions and public agencies. Continuous monitoring enhances safety while supporting earlier interventions. Centralized dashboards enable multi-site oversight and faster coordination with responders. Subsidized programs often begin with high-risk cohorts and expand as outcomes accumulate.

Distributors and retail networks. Demand is rising for differentiated offerings - slim watches, smart pendants, and family-care bundles. Partners who source Custom Elderly Devices can build recognizable brands and recurring service revenue.

Insurers and corporate health. Wearables support risk reduction and preventative engagement. Co-branded Elderly Smartwatch programs help payors cut claims while improving member experience.

✅ What to look for in procurement

• Clinical-grade reliability with clear alert logic and escalation paths.

• Security and privacy aligned with regional rules.

• Fleet management for over-the-air updates and device lifecycle control.

• Frictionless workflow fit - data should land where clinicians already work.

Why OEM/ODM Partnerships Matter

Speed, differentiation, and scale define success in the Elderly Care Wearables Market. An experienced OEM/ODM partner compresses timelines and reduces risk:

• Exclusive industrial design to protect your market position.

• Cost efficiency through optimized tooling and proven supply chains.

• Faster certifications and time-to-launch using validated modules.

• Deep integration support for healthcare and enterprise systems.

Our OEM/ODM Smartwatch programs balance aesthetics, comfort, and performance. With global 4G LTE coverage in 130+ countries and IP67 protection, organizations can deploy confidently across geographies. Role-based dashboards and interoperable data feeds help care teams act quickly without adding administrative burden.

✅ Future Outlook (2025-2030)

Expect more predictive insight and less reactive care. Wearable Healthcare Devices will surface early warnings for falls, cardio-respiratory stress, and functional decline before events happen. Government-backed initiatives will broaden access, while privacy frameworks mature and standardize encryption, consent, and retention. User-centered design will keep driving adherence: slimmer casings, better battery life, and materials that disappear into daily wear. Interoperability will be assumed - buyers will expect open, well-documented APIs and clean data exchange that plug into analytics and care coordination tools.

For B2B buyers, advantage will go to programs that combine high adherence, accurate detection, and actionable dashboards - with clear KPIs for safety, satisfaction, and cost containment.

Final Words

The Elderly Care Wearables Market is no longer speculative; it is a practical path to safer, more sustainable care. For distributors, providers, insurers, and public agencies, the opportunity is to procure scalable, secure, and Custom Elderly Devices that fit real-world workflows. JiAi Intelligent Technology is ready to help you design, brand, integrate, and deploy - aligning Elderly Smartwatch capabilities with your operational goals so seniors stay connected, caregivers stay informed, and organizations deliver measurable value.